Navigating the volatile world of cryptocurrency trading can be daunting, but significant profits are attainable with the right approach. This article outlines 5 simple strategies for profitable crypto trading, equipping you with the knowledge to make informed decisions and maximize your returns. We’ll explore techniques to mitigate risk, identify lucrative opportunities, and ultimately, achieve consistent success in the dynamic cryptocurrency market. Learn how to effectively manage your portfolio, understand market trends, and develop a winning trading plan to unlock the potential of crypto investments.

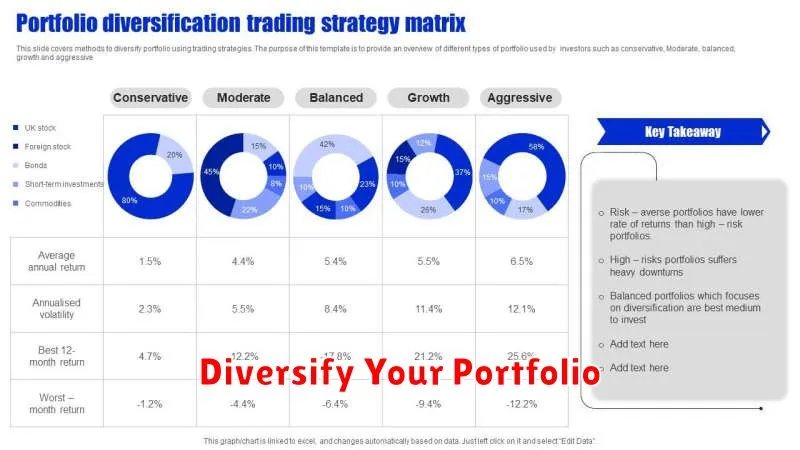

Diversify Your Portfolio

Diversification is crucial for mitigating risk in crypto trading. Don’t put all your eggs in one basket. Instead, spread your investments across different cryptocurrencies with varying market capitalizations and functionalities. This reduces the impact of a single asset’s price decline on your overall portfolio.

Consider diversifying across various asset classes as well. For example, alongside cryptocurrencies, allocate a portion of your portfolio to stablecoins or other less volatile assets to help balance out potential losses from more volatile cryptocurrencies. A well-diversified portfolio aims for a balance between risk and reward, limiting exposure to any single cryptocurrency’s volatility.

The ideal level of diversification depends on your risk tolerance and investment goals. Research different cryptocurrencies thoroughly before investing, considering factors such as their technology, team, and market position. Remember, a diversified portfolio isn’t a guarantee against losses, but it significantly reduces the impact of negative events.

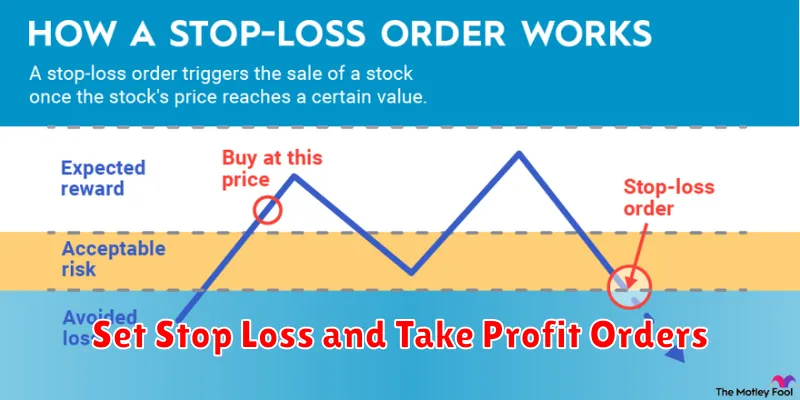

Set Stop Loss and Take Profit Orders

Setting stop-loss and take-profit orders is crucial for risk management in crypto trading. A stop-loss order automatically sells your cryptocurrency when it reaches a predetermined price, limiting potential losses. Conversely, a take-profit order automatically sells your cryptocurrency when it hits a specified target price, securing your profits.

Determining the appropriate levels for these orders requires careful consideration. Stop-loss levels should be set below support levels to minimize losses, while take-profit levels should align with resistance levels or profit targets based on your trading strategy and risk tolerance. Using both orders together helps you define a clear risk-reward ratio for each trade, improving your chances of long-term profitability.

The precise placement of stop-loss and take-profit orders will vary depending on your individual trading style and the specific cryptocurrency. However, consistent use of these orders is vital for managing risk and maximizing returns in the volatile crypto market. Remember to regularly review and adjust your orders as market conditions change.

Follow Market Trends

Staying informed about market trends is crucial for profitable crypto trading. This involves monitoring various factors impacting cryptocurrency prices, including overall market sentiment, regulatory news, technological advancements, and macroeconomic conditions.

Utilizing technical analysis, such as charting patterns and indicators (like moving averages and RSI), helps identify potential trends and predict price movements. Fundamental analysis, examining the underlying technology and adoption rate of a cryptocurrency, provides a long-term perspective on its value.

Following market news from reputable sources is vital. Significant events, such as regulatory changes or major partnerships, can significantly impact prices. Staying updated allows you to react swiftly to opportunities and mitigate potential risks.

Understanding market cycles – bull and bear markets – is essential. Different strategies are appropriate for each phase. During bull markets, focusing on growth opportunities may be advantageous, while bear markets call for caution and potentially shorting strategies or focusing on stablecoins.

Remember, consistently following market trends is not a guarantee of profit, but it significantly improves your chances of making informed, profitable trading decisions. Risk management remains paramount regardless of market trends.

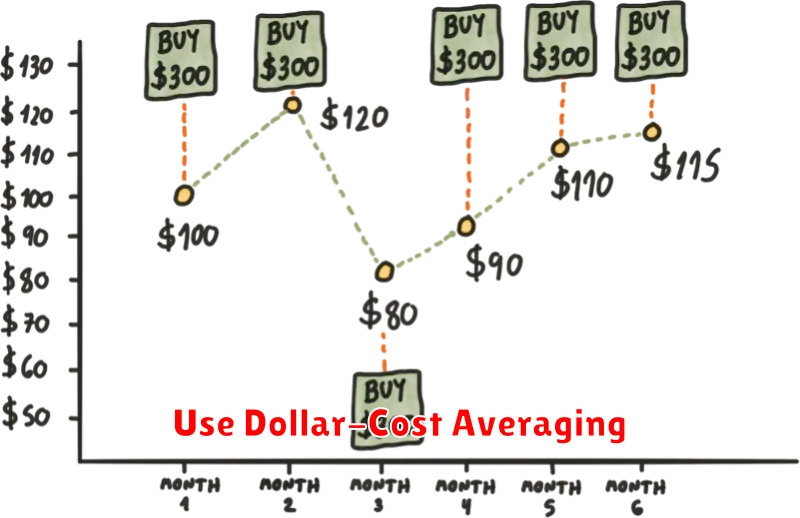

Use Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a simple yet effective strategy to mitigate risk in volatile cryptocurrency markets. Instead of investing a lump sum at a single point in time, DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations.

How it works: You invest a predetermined sum, say $100, every week or month. When the price is low, you buy more units; when the price is high, you buy fewer. This averages out your purchase price over time.

Benefits: DCA reduces the impact of market timing. It eliminates the need to predict market peaks and troughs, a difficult task even for experienced traders. This consistent approach can lead to better long-term returns compared to lump-sum investing, especially in volatile markets. It also reduces the emotional stress associated with potentially losing a significant amount of capital at once.

Considerations: While DCA reduces risk, it doesn’t guarantee profits. It may not be the optimal strategy in consistently rising markets. It also requires discipline to stick to the predetermined investment schedule, even when market conditions seem unfavorable.

In short: DCA offers a disciplined, risk-mitigating approach to cryptocurrency investing. Its simplicity and effectiveness make it a valuable tool for both novice and experienced traders.

Avoid Overtrading

Overtrading is a common pitfall for crypto traders, often leading to significant losses. It stems from excessive trading frequency, driven by impatience, fear of missing out (FOMO), or a lack of a well-defined trading plan.

Discipline is key to avoiding overtrading. Create a detailed trading strategy including entry and exit points, risk management, and position sizing. Strictly adhere to your plan, resisting the urge to make impulsive trades based on short-term market fluctuations.

Patience is crucial. Successful crypto trading requires time and a long-term perspective. Avoid chasing quick profits, focusing instead on consistent, sustainable gains. Allow your trades to play out according to your plan, even if the market experiences short-term volatility.

Implement effective risk management techniques. Never risk more capital than you can afford to lose on a single trade. Utilize stop-loss orders to limit potential losses and protect your investment.

Finally, maintain a trading journal to track your performance and identify patterns in your trading behavior. This can help you recognize and address any tendencies toward overtrading, improving your overall trading discipline and profitability.