The crypto market is known for its volatility and unexpected turns, making predictions a risky endeavor. However, by analyzing current trends and technological advancements, we can identify potential crypto market trends to watch in 2025. This article explores key areas such as the evolving regulatory landscape, the rise of decentralized finance (DeFi) and Web3 technologies, the impact of metaverse integration, and the influence of institutional investment on the future of cryptocurrencies. Prepare to navigate the exciting, yet unpredictable, future of the cryptocurrency market and discover what opportunities and challenges lie ahead in the coming years.

Adoption of Blockchain in Banking

In 2025, blockchain adoption in the banking sector is poised for significant growth. Banks are increasingly exploring its potential to streamline processes, enhance security, and reduce costs.

Cross-border payments are a prime area for blockchain implementation. The technology’s ability to facilitate faster, cheaper, and more transparent international transactions will drive wider adoption. Improved KYC/AML compliance through enhanced data management is another key driver.

However, scalability and regulatory uncertainty remain significant challenges. The industry’s success in addressing these issues will determine the pace of blockchain integration. Interoperability between different blockchain platforms is also crucial for widespread implementation.

Expect to see more pilot programs and strategic partnerships between banks and blockchain technology providers in 2025. Successful deployments will pave the way for larger-scale integration and wider industry acceptance of blockchain’s transformative potential within banking.

The Rise of Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is poised for significant growth in 2025. Building upon the advancements of previous years, we can expect to see more sophisticated and user-friendly DeFi applications.

Increased scalability and interoperability will be key drivers. Solutions addressing limitations in transaction speeds and network congestion will be crucial for wider adoption. The integration of different blockchain networks will also be a focus, allowing for greater asset liquidity and functionality.

Regulatory clarity will play a vital role. As governments worldwide grapple with the regulatory framework for cryptocurrencies, clearer guidelines will foster greater institutional investment and mainstream adoption of DeFi protocols.

The evolution of DeFi-specific infrastructure such as decentralized exchanges (DEXs), lending platforms, and stablecoins will continue, offering users more choice and potentially greater yields.

Furthermore, the development of innovative DeFi applications beyond traditional finance will likely emerge. This includes areas such as decentralized autonomous organizations (DAOs) and decentralized identity management solutions.

While challenges remain, the overall trajectory of DeFi suggests a continued rise in 2025, driven by technological innovation and increasing institutional and retail user interest. Security remains paramount and will be a critical aspect of its continued growth.

NFT Growth Beyond Art

Beyond the initial hype surrounding digital art, NFTs are poised for significant expansion in 2025. Their utility extends far beyond mere collectibles.

Real-world asset representation is a key area of growth. NFTs can tokenize ownership of physical items, streamlining processes and increasing transparency in industries such as luxury goods and supply chain management.

Gaming and metaverse integration will also drive NFT adoption. In-game items, virtual land, and unique character attributes can all be represented as NFTs, fostering a more dynamic and engaging digital experience for players.

The rise of NFT-based identity and access management systems is another potential trend. Secure and verifiable digital identities, controlled by the user, can revolutionize online authentication and data security.

Furthermore, decentralized finance (DeFi) and NFT integration promise to create innovative financial instruments. This convergence could lead to novel lending, borrowing, and investment opportunities.

Ultimately, the future of NFTs lies in their ability to provide real-world utility and enhance various sectors. Their evolving applications suggest a promising growth trajectory beyond their initial association with digital art.

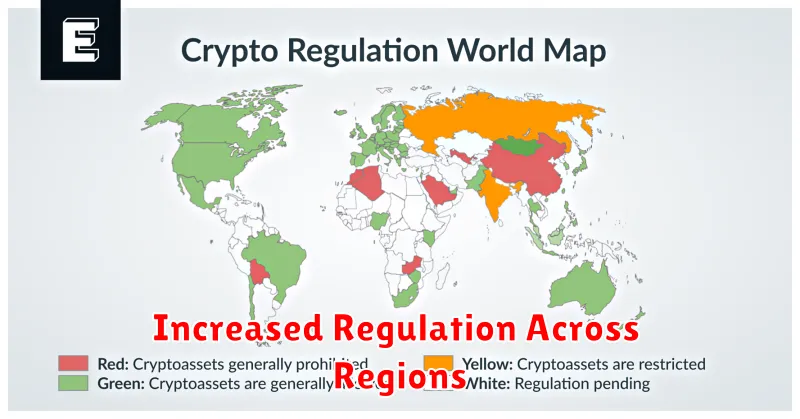

Increased Regulation Across Regions

Increased regulatory scrutiny is a dominant trend shaping the crypto landscape in 2025. Various jurisdictions are implementing stricter rules concerning cryptocurrency trading, stablecoins, and decentralized finance (DeFi). This includes enhanced Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance measures, potentially leading to more regulated exchanges and less anonymity for users.

The level and nature of regulation will vary significantly across regions. Some countries may adopt a more restrictive approach, potentially hindering innovation and limiting accessibility. Others might opt for a more balanced approach, fostering innovation while mitigating risks. This divergence will create a complex and fragmented regulatory environment, influencing where businesses operate and investors allocate capital.

Navigating this evolving regulatory landscape will be crucial for crypto businesses and investors in 2025. Staying abreast of local and international regulations, and adapting strategies accordingly, will be essential for survival and success.

Crypto’s Role in the Metaverse

Cryptocurrencies are poised to play a pivotal role in the future of the metaverse. Their decentralized nature aligns perfectly with the metaverse’s aim for a user-owned and controlled digital experience.

Digital assets, including NFTs (Non-Fungible Tokens), will be central to metaverse economies. These tokens can represent ownership of virtual land, in-game items, avatars, and even digital identities, facilitating secure transactions within metaverse environments.

Decentralized finance (DeFi) protocols will likely power the metaverse’s financial systems. Users can expect to see decentralized exchanges (DEXs) and lending platforms facilitating seamless transactions and financial interactions within virtual worlds.

Metaverse platforms are expected to integrate cryptocurrencies directly for in-world purchases and payments, creating a more fluid and integrated user experience. The adoption of various cryptocurrencies and stablecoins will provide multiple payment options for metaverse users.

Overall, the interplay between crypto and the metaverse is expected to drive innovation and growth, creating novel opportunities for users, developers, and businesses alike. The evolution of this relationship will be a key trend to watch in 2025 and beyond.