Protecting your crypto investments requires a proactive and multifaceted approach. This comprehensive guide will equip you with the knowledge and strategies to safeguard your digital assets against various threats, including hacks, phishing scams, and market volatility. Learn how to implement robust security measures, choose the right crypto wallets, diversify your portfolio to mitigate risk, and understand the importance of regular backups and strong passwords to effectively protect your cryptocurrency.

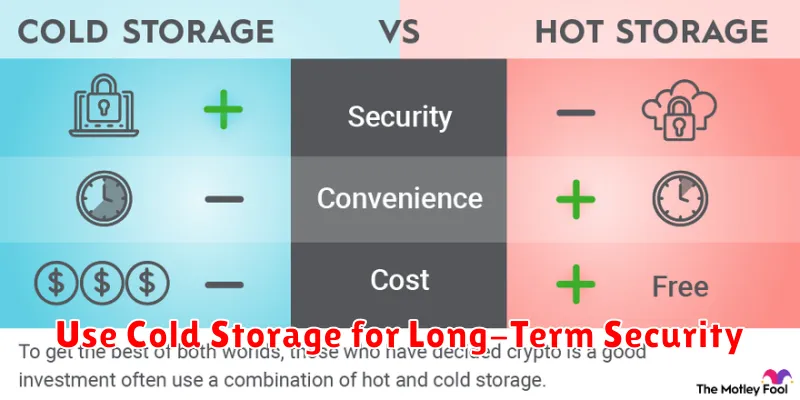

Use Cold Storage for Long-Term Security

For long-term crypto security, cold storage is paramount. Cold storage refers to storing your cryptocurrency offline, removing it from the vulnerability of online exchanges and internet-connected wallets.

Hardware wallets are the most secure form of cold storage. These physical devices act as offline vaults for your private keys, offering significant protection against hacking and malware. They provide an additional layer of security compared to software wallets or exchanges.

Paper wallets, while simple, are also a viable cold storage option. This involves printing your public and private keys offline. However, physical damage or loss can render your funds inaccessible, requiring careful storage and backup.

Choosing the right cold storage method depends on your technical proficiency and risk tolerance. Always prioritize security measures like strong passwords and multiple backups to protect your investment.

Enable Two-Factor Authentication (2FA)

Two-factor authentication (2FA) adds an extra layer of security to your crypto accounts. It requires two forms of verification to access your accounts, significantly reducing the risk of unauthorized access even if your password is compromised.

How it works: After entering your password (the first factor), you’ll need to provide a second factor, typically a code generated by an authenticator app (like Google Authenticator or Authy) on your phone, or a code sent via SMS or email. This second factor prevents hackers from accessing your account even if they obtain your password.

Enable 2FA immediately: Most reputable crypto exchanges and wallets offer 2FA. Locate the security settings within your account and activate this crucial feature. Choose a method (authenticator app is generally preferred for enhanced security) and follow the platform’s instructions carefully.

Importance of 2FA: Enabling 2FA is a critical step in protecting your crypto investments. It drastically minimizes the chances of theft or unauthorized transactions, safeguarding your funds from malicious actors.

Avoid Sharing Private Keys

Your private keys are the foundation of your cryptocurrency security. They grant exclusive access to your digital assets. Never share them with anyone, regardless of the situation. This includes friends, family, supposed “support” agents, or anyone claiming to offer assistance.

Sharing your private keys is equivalent to giving someone complete control over your crypto holdings. They could potentially transfer or spend your funds without your knowledge or consent. No legitimate service or individual will ever require your private keys.

If you suspect a phishing attempt or unauthorized access, act immediately. Change your passwords, secure your devices, and consider contacting the relevant cryptocurrency exchange or platform.

Remember: Protecting your private keys is paramount to securing your investments. Treat them with the utmost confidentiality and safeguard them diligently.

Regularly Monitor Your Portfolio

Regular monitoring of your cryptocurrency portfolio is crucial for safeguarding your investments. This involves actively tracking the performance of your assets, including their price fluctuations and overall market trends.

Frequency of monitoring depends on your risk tolerance and investment strategy. Daily checks might be necessary for active traders, while weekly or even monthly reviews suffice for long-term investors.

Key metrics to track include asset prices, portfolio value, and unrealized gains or losses. Pay attention to news and events that could impact your holdings, such as regulatory changes or technological developments.

Early detection of potential problems, such as significant price drops or security breaches, allows for timely intervention to minimize losses. Regular monitoring facilitates informed decision-making, enabling you to rebalance your portfolio, adjust your risk exposure, or take other necessary actions to protect your investments.

Stay Updated on Security Breaches

Staying informed about security breaches is crucial for protecting your crypto investments. Vulnerabilities in exchanges, wallets, or protocols can expose your funds to theft or loss. Regularly monitor reputable news sources and security blogs dedicated to the cryptocurrency space.

Social media can also be a valuable source, but always verify information from multiple sources before taking action. Be wary of unverified claims and avoid impulsive decisions based on potentially misleading information. Consider subscribing to security newsletters or following prominent security researchers on platforms like Twitter or LinkedIn.

By actively seeking out information on security breaches, you can proactively adjust your strategies, update your software, and diversify your holdings to minimize your risk and better protect your crypto investments.