Opening a crypto exchange account can be a gateway to the exciting world of digital currencies, allowing you to buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, and many others. This comprehensive guide will walk you through the entire process of opening a crypto exchange account, from choosing the right exchange platform to understanding the essential security measures needed to protect your crypto investments. Whether you’re a seasoned investor or a complete beginner, learn how to navigate the world of crypto trading safely and efficiently. Discover the steps involved in account verification, depositing funds, and making your first cryptocurrency trade.

Choosing a Trusted Exchange

Selecting a reliable cryptocurrency exchange is paramount before opening an account. A trustworthy exchange prioritizes the security of its users’ funds and personal information. Consider factors such as established operational history, robust security measures (like two-factor authentication and cold storage), and transparent regulatory compliance.

Reputation is key. Research the exchange thoroughly; look for reviews and independent audits assessing its security practices and customer service. Avoid exchanges with a history of security breaches or questionable practices. A strong track record of protecting user assets and handling disputes fairly demonstrates trustworthiness.

Check the exchange’s fees and trading volume. High trading volume often indicates liquidity and a larger, more active user base. However, excessively high fees can significantly impact your profits. Compare several exchanges before making a decision to ensure you’re getting competitive rates and a favorable trading environment.

Finally, ensure the exchange supports the cryptocurrencies you intend to trade. Not all exchanges list the same assets. Verify their availability before committing to a platform to avoid potential inconvenience later on.

Verifying Your Identity

Identity verification, also known as KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance, is a crucial step in opening a crypto exchange account. This process helps exchanges comply with regulations and prevent fraudulent activities.

Typically, you’ll need to provide personal information such as your full name, date of birth, address, and a government-issued ID (passport, driver’s license, etc.). Some exchanges may also require a proof of address document, like a utility bill.

The verification process usually involves uploading clear images or scans of your documents. Ensure the images are legible and meet the exchange’s specific requirements to avoid delays. The processing time varies depending on the exchange and the volume of applications.

Accurate information is essential; providing incorrect details can lead to account delays or even suspension. Once your identity is verified, you’ll gain full access to the exchange’s features, including trading and withdrawals.

Setting Up Security Features

Robust security is paramount when opening a crypto exchange account. Begin by choosing a strong, unique password; avoid easily guessable combinations. Consider using a password manager to securely store and generate complex passwords.

Enable two-factor authentication (2FA). This adds an extra layer of security, typically requiring a code from your phone or authenticator app in addition to your password. Many exchanges offer different 2FA options; choose the one you find most convenient and secure.

Regularly review your login history and device access. Immediately report any suspicious activity. Familiarize yourself with your exchange’s security settings and utilize features like email notifications for login attempts and withdrawals.

Consider using a hardware security key for enhanced protection. These physical devices add an extra layer of security beyond 2FA, making unauthorized access significantly more difficult. Be mindful of phishing scams and never share your password or 2FA codes with anyone.

Keep your antivirus software updated and run regular scans on your devices. Be cautious about clicking on suspicious links or downloading files from untrusted sources, as these can contain malware that compromises your security.

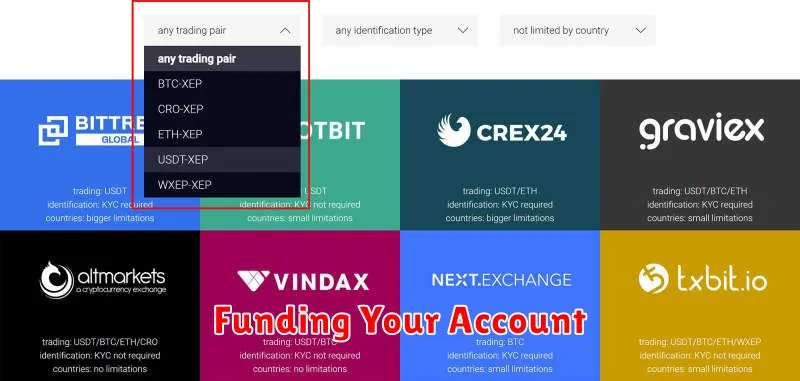

Funding Your Account

Once your account is verified, you can fund it with cryptocurrencies or fiat currencies, depending on the exchange’s supported methods. The specific options available will vary by exchange.

For cryptocurrency deposits, you’ll typically need the deposit address provided by the exchange. This address is unique to your account and the specific cryptocurrency. Carefully verify this address before sending funds to prevent irreversible loss.

Fiat currency deposits often involve linking a bank account or using a debit/credit card. Be aware of any associated fees and processing times, which can vary considerably.

After initiating a deposit, allow sufficient time for the transaction to process. You can usually monitor the status of your deposit within your exchange account. Always confirm the successful completion of the deposit before engaging in any trading activities.

Remember to securely store your private keys and adhere to all security guidelines provided by the exchange.

Placing Your First Trade

After successfully funding your account, you’re ready to place your first crypto trade. Begin by selecting the cryptocurrency pair you wish to trade (e.g., BTC/USD). This signifies you’re trading Bitcoin (BTC) using US Dollars (USD).

Next, decide whether you want to buy or sell. A buy order means you’re purchasing cryptocurrency with your fiat currency (USD, EUR, etc.), while a sell order means you’re exchanging your cryptocurrency for fiat currency.

Input the amount of cryptocurrency you wish to buy or sell, or the equivalent fiat amount. The exchange will automatically calculate the other side of the transaction based on the current market price.

Review all details carefully, ensuring the order type (market order for immediate execution or limit order for a specific price) and amount are correct. Once confirmed, click the place order button to execute your trade.

After placing your order, monitor its status. Market orders usually execute instantly, while limit orders may take time to fill, depending on market conditions. Always keep an eye on your transaction history to track your trades.