The cryptocurrency market remains highly volatile, presenting both significant opportunities and substantial risks. This article delves into crypto market predictions for 2025, exploring potential price movements for leading cryptocurrencies like Bitcoin and Ethereum, analyzing the impact of emerging blockchain technologies, and considering the influence of regulatory developments and macroeconomic factors on the overall market landscape. We examine expert opinions and technical analysis to provide a comprehensive outlook on the future of crypto investments in 2025, helping you navigate the complexities and potential of this dynamic sector.

Growth in Decentralized Finance (DeFi)

By 2025, Decentralized Finance (DeFi) is predicted to experience significant growth, driven by increasing user adoption and technological advancements. Improved scalability and interoperability solutions will likely address current limitations, leading to wider accessibility and a more seamless user experience.

Increased institutional investment in DeFi is also anticipated, further fueling its expansion. This will likely lead to the development of more sophisticated and regulated DeFi platforms. We can expect to see a broadening range of DeFi applications, including decentralized exchanges (DEXs), lending and borrowing platforms, and decentralized stablecoins, catering to a wider spectrum of users and use cases.

However, regulatory uncertainty remains a key challenge. The evolving regulatory landscape will significantly impact DeFi’s trajectory in 2025. Despite this, the underlying technology and the demand for decentralized financial services are expected to propel DeFi’s growth, making it a significant sector within the broader cryptocurrency market.

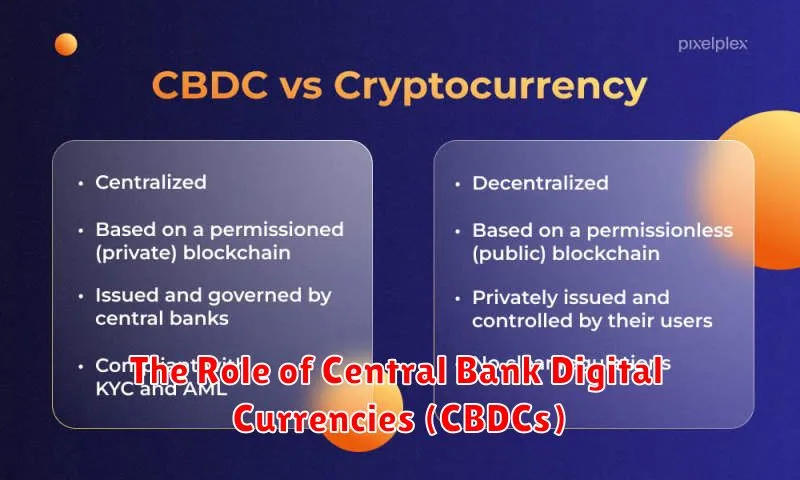

The Role of Central Bank Digital Currencies (CBDCs)

By 2025, Central Bank Digital Currencies (CBDCs) are predicted to play a more significant role in the global financial landscape. Their potential impact on the crypto market is multifaceted.

Increased competition is expected as CBDCs offer a digital alternative to existing cryptocurrencies, potentially impacting their market share. However, some believe that CBDCs could also boost overall crypto adoption by normalizing digital currencies and increasing public familiarity with digital assets.

The integration of CBDCs into existing financial systems could also influence the regulatory environment surrounding cryptocurrencies. This may lead to clearer guidelines and potentially reduce the volatility associated with crypto markets.

Furthermore, the technological advancements driven by CBDC development could have spillover effects on the broader cryptocurrency space, potentially leading to improvements in scalability, security, and interoperability of existing cryptocurrencies.

Ultimately, the precise impact of CBDCs on the crypto market in 2025 remains uncertain. It will depend on several factors including the pace of CBDC adoption, the specific design and features of different CBDCs, and the regulatory responses in various jurisdictions.

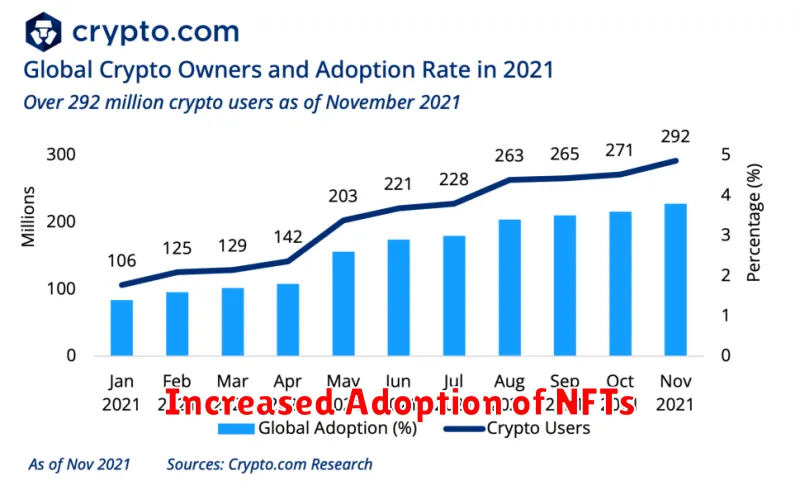

Increased Adoption of NFTs

By 2025, we predict a significant increase in NFT adoption across various sectors. This growth will be driven by several factors, including improved scalability on underlying blockchain networks, the development of more user-friendly interfaces, and the emergence of new use cases beyond digital art.

Mainstream brands are expected to further integrate NFTs into their marketing strategies, offering utility-driven tokens and exclusive digital experiences to enhance customer loyalty. The development of interoperable NFT standards will also facilitate greater cross-platform compatibility and liquidity.

While challenges remain, such as regulatory uncertainty and environmental concerns, the overall trend points towards a broadening market penetration of NFTs, extending beyond early adopters to a much wider audience. We anticipate NFTs becoming a more integral part of the digital economy, influencing sectors like gaming, entertainment, and supply chain management.

Advances in Blockchain Technology

Scalability improvements are crucial for broader cryptocurrency adoption. Solutions like sharding and layer-2 scaling solutions are expected to significantly increase transaction throughput and reduce fees in 2025.

Interoperability between different blockchains will become increasingly important. Cross-chain communication protocols and bridges will allow for seamless transfer of assets and data between various networks.

Privacy-enhancing technologies, such as zero-knowledge proofs and homomorphic encryption, are anticipated to gain traction, offering greater confidentiality and security for transactions and data stored on the blockchain.

Advancements in consensus mechanisms will likely focus on energy efficiency and security. Proof-of-Stake (PoS) and other environmentally friendly alternatives to Proof-of-Work (PoW) will continue to dominate.

The development of more user-friendly interfaces and decentralized applications (dApps) will drive greater mainstream adoption. Improved usability and accessibility will be key factors in expanding the crypto market.

New Regulatory Frameworks Worldwide

Emerging regulatory frameworks globally will significantly shape the crypto market in 2025. Jurisdictions worldwide are adopting diverse approaches, ranging from outright bans to comprehensive licensing regimes. This creates uncertainty for investors and businesses.

The US is expected to see further regulatory clarity, though the exact form remains debated. EU’s Markets in Crypto-assets (MiCA) regulation, set to take effect in 2024, will establish a standardized framework for crypto assets within the European Union, impacting trading and issuance.

Asia presents a mixed picture, with some countries embracing crypto innovation while others maintain a cautious approach. This varied regulatory landscape will likely lead to market fragmentation, with different regions operating under distinct rules.

The overall impact of these new regulations will be a more regulated and potentially less volatile market, although this could also hinder innovation and limit accessibility in some regions. Predicting the precise effects requires close monitoring of regulatory developments throughout 2024.