Entering the exciting yet volatile world of cryptocurrency can be daunting, especially for newcomers. Navigating the digital landscape requires vigilance to avoid crypto scams. This comprehensive guide will equip you with the knowledge and strategies to protect yourself from investment scams, rug pulls, and other common cryptocurrency fraud schemes. Learn how to identify red flags, secure your digital assets, and make informed decisions to ensure a safe and successful start in the world of crypto trading and blockchain technology.

Recognizing Phishing Websites

Phishing websites are a major threat in the cryptocurrency world. These sites mimic legitimate platforms to steal your login credentials, private keys, or seed phrases. Careful observation is crucial for avoiding them.

Look for inconsistencies. Check the website’s URL for misspellings or unusual characters. Legitimate cryptocurrency exchanges usually have secure HTTPS connections (indicated by a padlock icon in your browser’s address bar). Be wary of sites lacking this.

Examine the website’s design and content. Phishing sites often have poor grammar, unprofessional design, or suspicious promises of unusually high returns. Compare the site to the official website of the platform it’s mimicking. Significant differences should raise red flags.

Never enter your sensitive information on a website that feels suspicious. If you’re unsure, contact the legitimate platform directly through their official channels to verify the website’s authenticity before proceeding.

Remember, legitimate platforms will never ask for your seed phrase directly. If a website requests this, it’s almost certainly a phishing attempt.

By employing these precautions, you can significantly reduce your risk of falling victim to phishing scams and protect your cryptocurrency investments.

Avoiding Fake ICOs

The cryptocurrency market is rife with scams, and Initial Coin Offerings (ICOs) are a particularly vulnerable area. Many fraudulent ICOs promise unrealistic returns and disappear with investors’ money. Due diligence is crucial to avoid these schemes.

Before investing in any ICO, thoroughly research the project. Look for a detailed whitepaper outlining the project’s goals, technology, and team. A vague or poorly written whitepaper is a major red flag. Investigate the team’s background and experience; are they credible individuals with relevant expertise?

Be wary of ICOs that make exaggerated claims of guaranteed high returns or promise quick riches. Legitimate projects focus on the long-term potential of their technology and its real-world applications. Examine the project’s roadmap and assess its feasibility.

Check for a transparent and auditable financial structure. Where is the money being raised going? Look for independent audits of the project’s finances. Also, be wary of ICOs that operate anonymously or lack clear contact information.

Finally, remember that no investment is risk-free. Even with thorough due diligence, there’s always a chance of loss. Only invest what you can afford to lose and diversify your portfolio to mitigate risk. Consider consulting with a financial advisor before investing in any cryptocurrency project.

Checking the Credibility of Exchanges

Choosing a reputable cryptocurrency exchange is paramount to avoiding scams. Security should be your top priority. Look for exchanges that have robust security measures in place, including two-factor authentication (2FA), cold storage for a significant portion of their assets, and a proven track record of resisting hacking attempts. Research their history for any past security breaches or incidents.

Regulation and Licensing are crucial indicators of legitimacy. Check if the exchange is registered with and regulated by relevant financial authorities in your jurisdiction or a reputable jurisdiction. While regulation isn’t a foolproof guarantee of safety, it often signifies a higher level of compliance and oversight.

Transparency is key. A credible exchange will openly share information about its operations, fees, and security practices. Look for easily accessible information on their website, including details about their team, location, and auditing processes. Avoid exchanges that lack transparency or are deliberately vague about their operations.

User Reviews and Reputation offer valuable insights. Examine online reviews from other users on platforms like Trustpilot or Reddit. Look for consistent feedback regarding the exchange’s reliability, customer service, and ease of use. Be wary of exchanges with overwhelmingly negative reviews or a significant number of unresolved complaints.

Finally, always be cautious of excessively high returns or promises. If an exchange offers unrealistically high interest rates or guarantees exceptional profits, it’s a significant red flag and likely a scam. Remember that investing in cryptocurrency always involves risk, and promises of guaranteed returns are often deceptive.

Protecting Your Private Keys

Private keys are the passwords to your cryptocurrency. Losing them means losing access to your funds, permanently. Therefore, securing them is paramount.

Never share your private keys with anyone. Legitimate services will never request them. Beware of phishing scams disguised as official websites or emails.

Use a reputable hardware wallet. These physical devices store your keys offline, significantly reducing the risk of hacking. Alternatively, employ strong, unique passwords and utilize multi-factor authentication (MFA) if available on your chosen platform.

Regularly back up your private keys, but store them securely offline. Consider using a passphrase for added security and write them down on paper, storing them in a safe and discreet place. Avoid digital backups unless employing strong encryption and robust security measures.

Stay vigilant. Crypto scams are sophisticated. Only use verified and trusted platforms and exchanges. Be wary of unsolicited offers and remember: If it sounds too good to be true, it probably is.

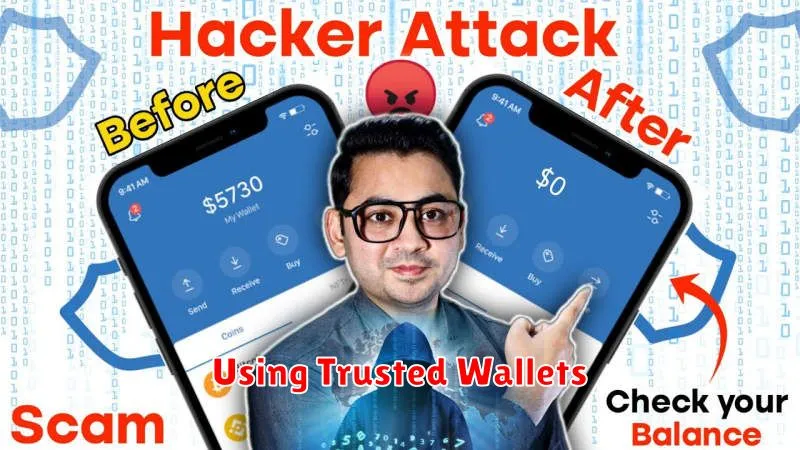

Using Trusted Wallets

One of the most crucial steps in avoiding crypto scams is using a trusted wallet. This is where you’ll store your cryptocurrency, so security is paramount.

Hardware wallets, like Ledger and Trezor, are considered the most secure option. They store your private keys offline, making them virtually immune to hacking attempts online.

Software wallets, while convenient, carry a higher risk. Choose reputable providers with strong security features and a proven track record. Regularly update your software and enable two-factor authentication (2FA).

Never share your seed phrase or private keys with anyone. These are essential for accessing your funds, and revealing them could lead to significant losses.

Before choosing a wallet, thoroughly research its reputation and security features. Look for reviews and independent security audits to ensure its trustworthiness.

By diligently selecting and managing your wallet, you significantly reduce the likelihood of falling victim to crypto scams.