Navigating the volatile world of cryptocurrency trading can be both exciting and daunting. While the potential for high rewards is alluring, many new and even experienced traders fall prey to common mistakes that can lead to significant losses. This article will delve into five common crypto trading mistakes, including FOMO (fear of missing out), emotional trading, ignoring risk management, lack of research, and over-diversification. Understanding these pitfalls and learning how to avoid them is crucial for successful crypto investment and mitigating potential financial risks. Learn how to protect your assets and enhance your trading strategies by reading on.

FOMO Trading

Fear of missing out (FOMO) is a common pitfall in crypto trading. It leads to impulsive decisions, often resulting in poor entry and exit points.

Driven by the excitement of rising prices, traders succumb to FOMO, buying high and potentially missing crucial corrections.

Avoiding FOMO requires a disciplined approach. This includes having a well-defined trading plan, sticking to your risk management strategy, and utilizing technical analysis to identify potential entry and exit points based on objective indicators, not emotions.

Emotional detachment is key. Before making any trade, take a step back and analyze the situation rationally. Consider your overall portfolio, risk tolerance, and the potential downside before succumbing to the pressure of missing a perceived opportunity.

Remember, consistent profitability in crypto trading is a marathon, not a sprint. Patience and a well-thought-out strategy will always trump impulsive decisions driven by FOMO.

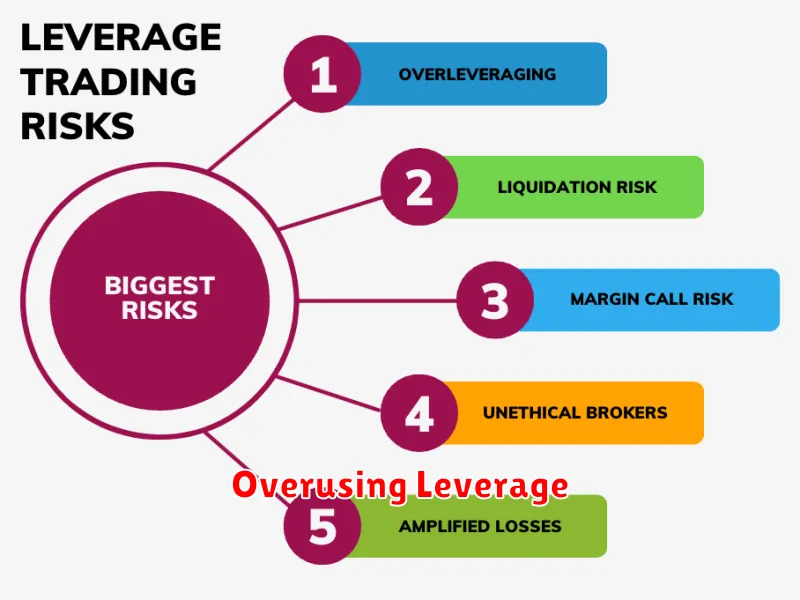

Overusing Leverage

One of the most significant pitfalls in cryptocurrency trading is the overuse of leverage. Leverage magnifies both profits and losses, meaning a small market movement can lead to substantial gains or devastating losses. While it can amplify returns, the risk of liquidation – losing your entire investment – is significantly increased with higher leverage.

Avoid this mistake by starting with low leverage or no leverage at all, especially when you’re new to trading or dealing with volatile assets. Gradually increase leverage only as your understanding and experience grow, and always ensure you have a robust risk management strategy in place, including stop-loss orders to limit potential losses.

Remember that high leverage amplifies risk exponentially. A seemingly small percentage move against your position can quickly wipe out your trading capital. Conservative leverage usage is crucial for long-term success and preserving your trading funds.

Neglecting Stop Losses

One of the most critical mistakes in crypto trading is neglecting to use stop-loss orders. These orders automatically sell your asset when it reaches a predetermined price, limiting potential losses.

Without a stop loss, a sudden market downturn can wipe out your entire investment. Emotional decision-making often prevents traders from selling at a loss, leading to significantly larger losses than anticipated.

Implementing stop-loss orders is crucial for risk management. While they don’t guarantee profits, they provide a safety net, protecting your capital from catastrophic events. Determining the appropriate stop-loss price requires careful consideration of your risk tolerance and market volatility. A well-placed stop loss can significantly reduce the impact of unfavorable market movements.

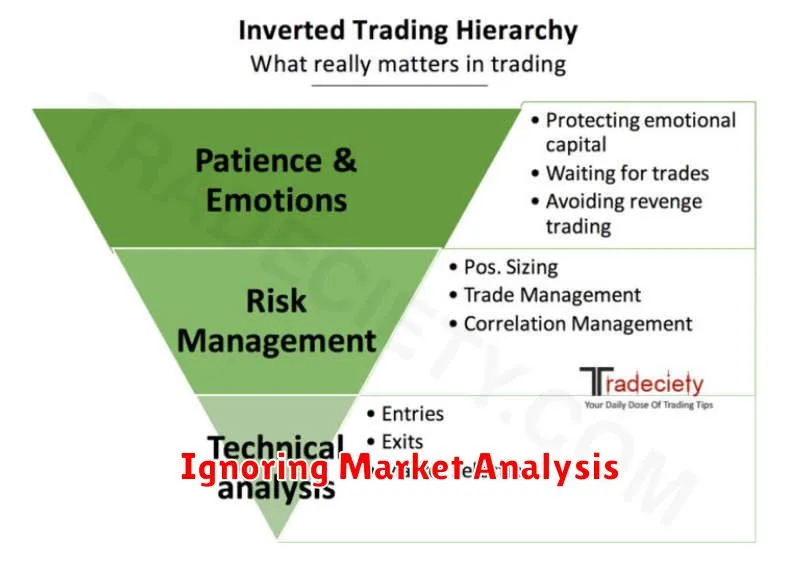

Ignoring Market Analysis

One of the most significant errors novice crypto traders make is ignoring market analysis. Successful trading hinges on understanding market trends, price movements, and overall market sentiment. Failing to conduct thorough research, including technical and fundamental analysis, leads to uninformed decisions and increased risk of losses.

Technical analysis involves studying price charts and indicators to identify patterns and predict future price movements. Fundamental analysis focuses on the underlying technology, adoption rates, and overall project viability of a cryptocurrency. Ignoring either aspect leaves traders vulnerable to market fluctuations and potentially disastrous investments.

By dedicating time to market research and analysis, traders can identify promising opportunities, mitigate risk, and make more informed decisions. This includes utilizing various charting tools, following reputable crypto news sources, and understanding market cycles. Proper market analysis is a cornerstone of successful crypto trading, and its neglect is a recipe for financial hardship.

Trading Without a Clear Strategy

One of the most significant mistakes novice and even experienced crypto traders make is trading without a clear strategy. This lack of planning often leads to impulsive decisions driven by emotions like fear and greed, rather than rational analysis. A well-defined strategy should encompass your risk tolerance, investment goals, preferred trading style (e.g., day trading, swing trading, long-term holding), and a defined entry and exit plan for each trade. Without this framework, you’re essentially gambling, significantly increasing your chances of substantial losses.

A solid trading plan should include technical and/or fundamental analysis to identify potential opportunities and manage risk effectively. It should specify how much capital to allocate per trade, your stop-loss and take-profit levels, and your overall portfolio diversification strategy. Backtesting your strategy on historical data is crucial before implementing it with real funds. By developing and adhering to a robust strategy, you can significantly improve your chances of consistent profitability and minimize emotional trading.