Are you looking to invest in cryptocurrencies with high growth potential? Navigating the volatile world of digital assets can be challenging, but with careful research and a strategic approach, you can significantly increase your chances of success. This article presents 5 key tips to help you identify promising cryptocurrencies poised for significant gains. Learn how to evaluate market trends, understand blockchain technology, assess project fundamentals, and manage risk effectively to maximize your potential for high returns in the exciting world of crypto investing.

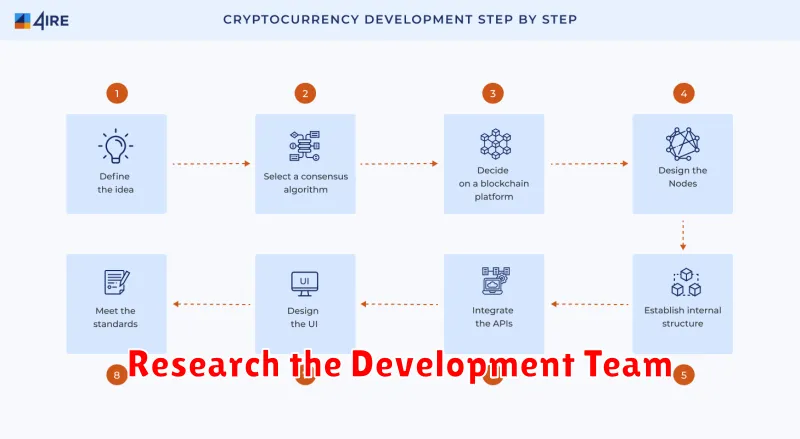

Research the Development Team

Before investing in any cryptocurrency, thoroughly research the development team behind it. A strong team is crucial for a project’s success. Look for experienced developers with proven track records in blockchain technology and software development. Investigate their backgrounds, expertise, and previous accomplishments.

Examine the team’s transparency. Are their identities publicly known? Do they actively engage with the community through forums and social media? A lack of transparency can be a red flag, suggesting potential risks.

Assess the team’s size and structure. A well-defined team structure with clear roles and responsibilities demonstrates organization and efficiency. A larger, more established team generally indicates greater stability and resources. However, a smaller, highly skilled team can also be very effective.

Consider the team’s commitment to the project’s long-term vision. Are they actively developing and improving the cryptocurrency? Do they have a roadmap outlining future plans and updates? A dedicated team is more likely to sustain growth and development over time.

Finally, pay attention to any controversies or negative news surrounding the team. Past issues or scandals can significantly impact a project’s credibility and future prospects. A thorough due diligence process is paramount before making any investment decisions.

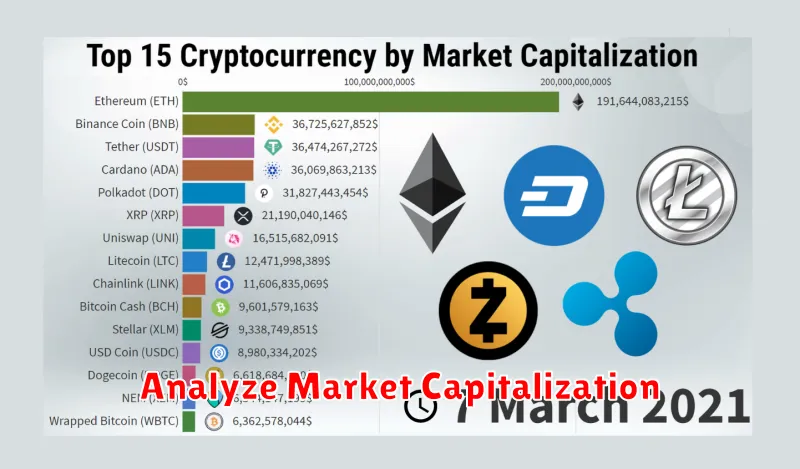

Analyze Market Capitalization

Analyzing market capitalization is crucial for assessing a cryptocurrency’s growth potential. Market cap, calculated by multiplying the current price by the total number of coins in circulation, indicates the overall size and valuation of a cryptocurrency project.

A larger market cap generally suggests greater stability and maturity, implying lower volatility. However, it also signifies less room for significant price appreciation compared to smaller-cap cryptocurrencies. Conversely, smaller market caps often indicate higher risk but present a greater potential for explosive growth if the project gains traction.

Therefore, a balanced approach is needed. While extremely low market caps may signal high risk, focusing solely on large-cap cryptocurrencies might limit exposure to high-growth opportunities. Consider the project’s fundamentals in conjunction with its market cap to make an informed decision.

Study Past Performance Trends

Analyzing past performance is crucial for identifying cryptocurrencies with high growth potential. While past success doesn’t guarantee future returns, it provides valuable insights. Focus on long-term trends rather than short-term fluctuations. Examine price charts, considering factors such as market capitalization, trading volume, and historical volatility. Look for consistent upward trends and periods of sustained growth, indicating a potentially strong and resilient cryptocurrency.

Consider using technical analysis tools to identify patterns and predict future price movements. However, remember that technical analysis is not foolproof, and should be used in conjunction with fundamental analysis. Due diligence is essential; researching the project’s whitepaper, team, and overall market position will help contextualize the historical data.

Comparing the performance of a given cryptocurrency to its competitors is also critical. Identifying outperformers within a specific sector or niche can highlight promising investments. Remember to be aware of market cycles and avoid basing decisions solely on recent short-term gains or losses.

Check Real-World Use Cases

Before investing in a cryptocurrency, assess its real-world applications. Strong real-world utility often correlates with higher growth potential. Does the cryptocurrency power a decentralized application (dApp) with substantial user adoption? Is it integrated into existing systems, providing a practical solution to a real-world problem? For example, cryptocurrencies facilitating secure supply chain management or enabling fast and inexpensive cross-border payments demonstrate tangible value.

Look for evidence of practical use beyond mere speculation. The more widely adopted and integrated a cryptocurrency is, the greater its chances of sustained growth. This goes beyond simply looking at the market capitalization; it requires deeper research into the cryptocurrency’s actual usage and impact.

Consider the scale and scope of real-world applications. A cryptocurrency used in a niche market might experience limited growth compared to one with broader applicability and integration potential. The broader the applicability, the greater the potential for mass adoption and, consequently, price appreciation.

Review the Tokenomics

Understanding a cryptocurrency’s tokenomics is crucial for assessing its growth potential. This involves analyzing the total supply of tokens, the token distribution (e.g., allocation to founders, team, investors, and the public), and the token release schedule. A well-designed tokenomics model usually features a controlled inflation rate, preventing excessive dilution and maintaining value.

Examine the utility of the token within its ecosystem. Does it offer genuine value beyond mere speculation? A strong use case—such as facilitating transactions, securing a network, or providing access to services—contributes significantly to long-term demand and price appreciation.

Look for transparency in the tokenomics. Are the details clearly documented and easily accessible? A lack of transparency raises red flags and should be considered a significant risk factor. Scrutinize the burn mechanisms, if any, as they can positively impact token scarcity and price.

Consider the token distribution model’s fairness. A heavily concentrated token distribution amongst a few key holders might signal a higher risk of manipulation and lower potential for widespread adoption. Conversely, a broader distribution can foster a more robust and resilient community.

Finally, analyze the economic incentives embedded within the tokenomics. Do they align with the project’s goals and encourage long-term growth and community participation? Reward mechanisms, staking opportunities, and other incentives play a key role in driving adoption and value appreciation.