Stay informed on the ever-evolving landscape of cryptocurrency with our comprehensive coverage of the latest crypto news and market updates for 2025. We deliver insightful analysis on Bitcoin, Ethereum, and other leading altcoins, providing you with crucial information to navigate the dynamic world of digital assets. Discover expert opinions, market trends, and breaking news to make informed decisions in the exciting and potentially lucrative crypto market of 2025. Gain a competitive edge with our in-depth reporting on blockchain technology, crypto regulation, and emerging cryptocurrency projects.

Bitcoin Price Trends

Predicting Bitcoin’s price in 2025 remains challenging, as it’s influenced by numerous interconnected factors. While no one can definitively state the exact price, several key trends may impact its value.

Adoption rate will play a crucial role. Wider acceptance by institutional investors and mainstream consumers could drive prices upward. Conversely, increased regulatory scrutiny or a lack of widespread adoption might suppress growth.

Technological advancements within the Bitcoin network, such as the Lightning Network’s maturation, could enhance scalability and transaction speed, potentially boosting demand and value.

Macroeconomic conditions, such as inflation rates and global economic stability, also exert considerable influence. Periods of economic uncertainty might lead investors to seek refuge in Bitcoin, potentially increasing its price. Conversely, a strengthening global economy could lead to decreased demand.

Finally, market sentiment and speculative trading remain significant drivers. Positive news and technological breakthroughs can trigger rapid price increases, while negative news or market corrections can cause sharp declines.

In summary, the Bitcoin price trend in 2025 will likely depend on a complex interplay of adoption, technology, macroeconomic factors, and market sentiment. Therefore, any price prediction should be viewed with caution.

Ethereum Upgrades and Developments

Ethereum’s development in 2025 is expected to center around scalability and efficiency improvements built upon the success of previous upgrades. The sharding implementation, a key component of Ethereum 2.0, is anticipated to be further refined, enhancing transaction throughput and reducing congestion.

Focus will likely remain on optimizing the consensus mechanism, potentially exploring advancements in proof-of-stake (PoS) to minimize energy consumption and maximize network security. Layer-2 scaling solutions, such as rollups, will continue to play a crucial role in providing faster and cheaper transactions, easing the burden on the main Ethereum blockchain.

Further improvements to the developer experience are also expected, with ongoing efforts to make Ethereum more accessible and user-friendly for developers building decentralized applications (dApps). This could include enhancements to the smart contract language and tooling.

While specific details may vary, the overall direction points towards a more robust, scalable, and efficient Ethereum network, further solidifying its position as a leading platform for decentralized technologies.

New Cryptocurrency Launches

The cryptocurrency market continues to evolve with numerous new projects launching throughout 2025. These range from layer-1 blockchains aiming to improve scalability and transaction speeds, to layer-2 solutions designed to enhance existing networks like Ethereum. Many projects focus on decentralized finance (DeFi), offering innovative lending, borrowing, and trading platforms.

Several new cryptocurrencies are also emerging with a focus on specific use cases, such as supply chain management, digital identity, and gaming. This increased specialization reflects the growing maturity of the crypto space and a shift away from purely speculative investments.

It’s crucial for investors to conduct thorough due diligence before investing in any new cryptocurrency, considering factors such as the project’s whitepaper, team experience, and overall market sentiment. The high volatility and inherent risks associated with new cryptocurrency projects necessitate a cautious approach.

Regulatory scrutiny is also increasing, influencing the development and adoption of new cryptocurrencies. Projects that prioritize compliance and transparency are likely to attract more mainstream attention and investment.

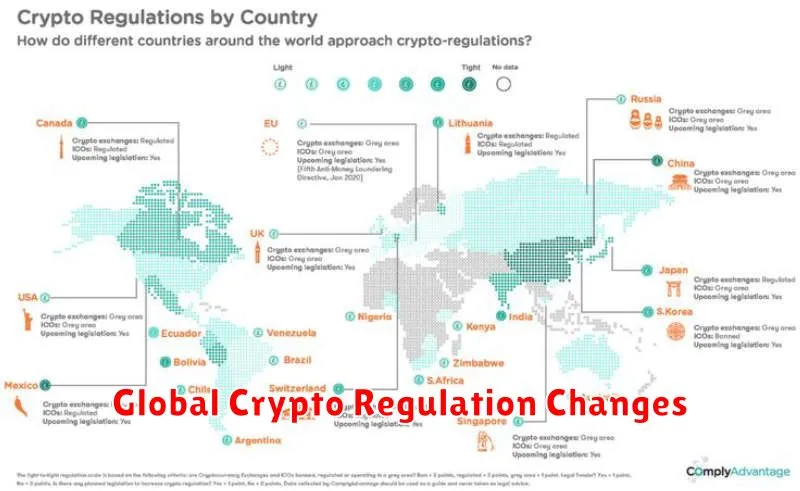

Global Crypto Regulation Changes

The global regulatory landscape for cryptocurrencies is rapidly evolving in 2025. Increased scrutiny from governments worldwide is leading to a patchwork of differing regulations across jurisdictions. Key areas of focus include anti-money laundering (AML) compliance, consumer protection, and the taxation of digital assets.

Several major economies have implemented or are in the process of implementing comprehensive regulatory frameworks. This includes establishing licensing requirements for crypto exchanges, defining legal definitions for various crypto assets, and implementing robust KYC (Know Your Customer) and AML protocols. These frameworks vary significantly in their scope and strictness, creating challenges for global crypto businesses.

Harmonization of regulations remains a significant hurdle. The lack of a unified global approach creates uncertainty and fragmentation within the crypto market. International collaborations are underway to address this, but the process is complex and slow.

Ongoing debates surround the classification of cryptocurrencies as securities or commodities, which have significant implications for regulatory oversight and taxation. The legal ambiguities surrounding decentralized finance (DeFi) and non-fungible tokens (NFTs) also pose significant challenges for regulators.

The evolving regulatory landscape will continue to shape the future of the cryptocurrency market in 2025. Businesses operating in the crypto space must navigate this evolving environment and adapt to the specific regulations in each jurisdiction where they operate. Compliance is paramount to avoid significant penalties and maintain operational viability.

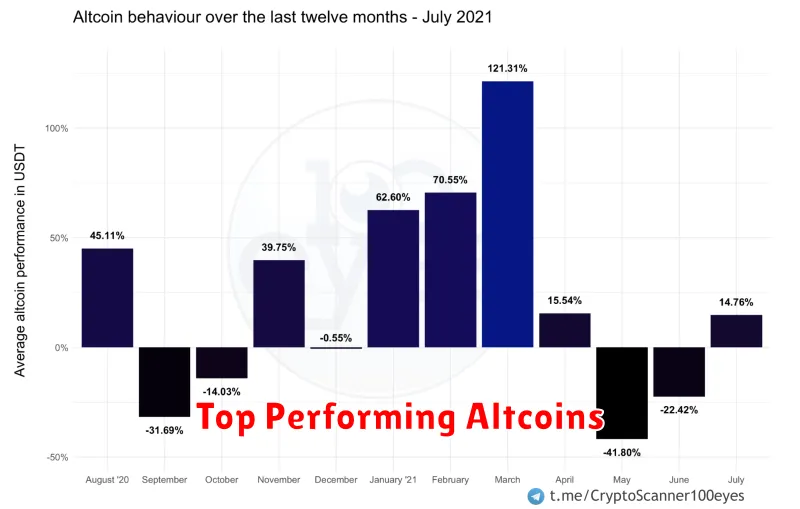

Top Performing Altcoins

The cryptocurrency market in 2025 shows significant growth in several altcoins. Ethereum (ETH) continues to be a dominant force, driven by its robust ecosystem and development activity in areas like decentralized finance (DeFi) and non-fungible tokens (NFTs).

Solana (SOL) maintains a strong position due to its speed and scalability, making it attractive for various applications. Cardano (ADA), focusing on research and development, has steadily increased its adoption, showcasing positive growth prospects.

Polygon (MATIC), a scaling solution for Ethereum, has seen considerable success, facilitating the growth of decentralized applications. The performance of these and other top-performing altcoins is influenced by factors such as technological advancements, market sentiment, and regulatory developments.

It’s crucial to note that the cryptocurrency market remains volatile. While these altcoins have shown strong performance, investing in cryptocurrencies carries inherent risks. Thorough research and understanding of the underlying technologies are essential before making any investment decisions.