Navigating the complex world of cryptocurrency regulations is crucial for investors and businesses alike. With the rapid evolution of the digital asset landscape, understanding the anticipated crypto regulations in 2025 is paramount. This article will delve into the potential regulatory changes expected globally, exploring key areas such as taxation, security, anti-money laundering (AML), and Know Your Customer (KYC) compliance. We’ll examine how these upcoming regulations might affect your crypto investments and blockchain technology projects, providing you with the knowledge to confidently navigate the evolving regulatory environment.

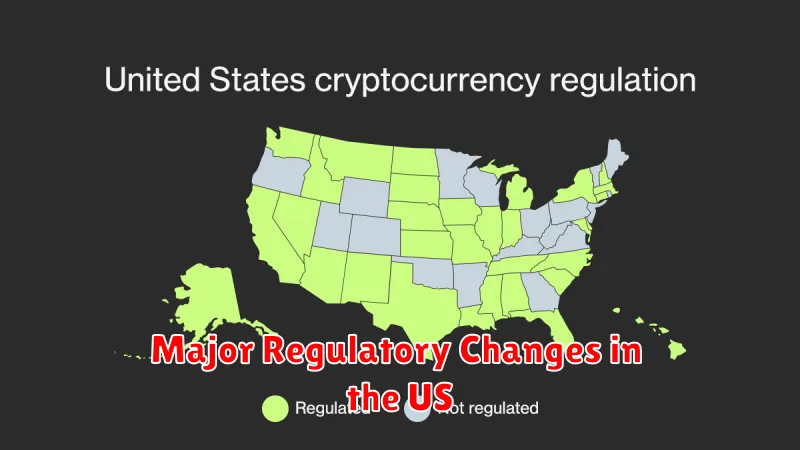

Major Regulatory Changes in the US

The US regulatory landscape for cryptocurrencies in 2025 is expected to be significantly shaped by several key developments. Increased clarity on securities classification is anticipated, potentially leading to more robust regulatory frameworks for various crypto assets. This could involve a more defined approach to determining which digital assets are considered securities under the Howey Test and subsequent application of existing securities laws.

Furthermore, expect strengthened oversight of stablecoins. Regulations might focus on reserve requirements, transparency, and risk management to mitigate systemic risks associated with these assets. This could involve stricter guidelines concerning the types of assets held as collateral and more frequent audits of reserves.

Comprehensive regulatory frameworks are likely to emerge, moving beyond piecemeal approaches. This might involve the creation of a unified regulatory body or a more coordinated effort among existing agencies like the SEC, CFTC, and FinCEN. Such comprehensive legislation would aim to establish clearer guidelines for various aspects of the crypto industry, from trading and custody to taxation and anti-money laundering (AML) compliance.

Finally, developments in decentralized finance (DeFi) regulation are expected. Given the decentralized and borderless nature of DeFi, regulatory challenges are substantial. Expect initiatives aimed at balancing innovation with consumer protection, possibly focusing on specific DeFi protocols or activities that pose significant risks.

The EU’s Crypto Framework

The European Union is pioneering comprehensive crypto regulation with the Markets in Crypto-Assets (MiCA) regulation. Scheduled to come into effect in 2024, MiCA aims to create a unified regulatory framework across the EU for cryptocurrencies and related services.

MiCA will introduce licensing requirements for crypto-asset service providers (CASPs), including exchanges and custodians, establishing standards for market integrity, consumer protection, and anti-money laundering (AML). It also categorizes crypto assets, imposing different requirements based on their characteristics. This includes stablecoins, which will face stricter scrutiny.

The framework aims to foster innovation while mitigating risks associated with crypto assets. While details are still being finalized, MiCA represents a significant step towards a harmonized and regulated crypto market within the EU, impacting businesses operating within its borders and shaping global regulatory trends.

Asia’s Growing Crypto Policies

Asia is witnessing a diverse and rapidly evolving landscape of cryptocurrency regulations. Different countries within the region are adopting varying approaches, ranging from outright bans to more permissive frameworks encouraging innovation while mitigating risks.

Several nations are developing comprehensive legal frameworks to regulate crypto activities, including licensing requirements for exchanges, taxation of crypto transactions, and consumer protection measures. These initiatives aim to balance the potential benefits of blockchain technology with the need to protect investors and maintain financial stability.

Singapore, for example, has emerged as a regional leader in establishing clear guidelines for cryptocurrency businesses, fostering a more regulated yet innovative environment. Other countries, such as Hong Kong and Japan, are also making strides towards creating regulatory clarity, attracting significant investment in the fintech sector.

However, challenges remain. Regulatory inconsistencies across different Asian markets create complexities for businesses operating in the region. The fast-paced evolution of crypto technologies and business models also presents a challenge for regulators, who need to adapt quickly to stay relevant and effective.

Looking ahead, regional cooperation and harmonization of regulatory approaches will be crucial to facilitate cross-border crypto transactions and promote a stable and sustainable ecosystem. The development of clear and consistent regulatory frameworks will ultimately shape the future of the cryptocurrency industry in Asia.

Impacts of Taxation on Crypto

The taxation of cryptocurrency remains a significant area of uncertainty and variation globally. Tax liabilities can arise from various activities, including trading, staking, mining, and airdrops. The classification of crypto assets (property, currency, or security) significantly influences how they are taxed. For example, some jurisdictions treat crypto gains as capital gains, subject to long-term or short-term rates depending on holding periods, while others might classify them as income or subject them to different tax schemes altogether.

Reporting requirements also vary widely. Some countries mandate the reporting of all crypto transactions exceeding certain thresholds, while others have yet to establish clear reporting mechanisms. This lack of uniformity presents challenges for individuals and businesses involved in crypto transactions, especially those operating across multiple jurisdictions. The complexity surrounding the valuation of crypto assets for tax purposes further adds to the difficulty. Fluctuating prices make accurate calculation challenging, and various methods exist, each with its implications.

These discrepancies lead to significant compliance burdens and potential risks, such as underreporting or misreporting of income, leading to penalties and legal consequences. Furthermore, the global nature of cryptocurrency makes it difficult to enforce tax regulations effectively. The evolution of crypto tax laws continues, and staying informed about specific regulations in your jurisdiction is crucial to avoid legal problems.

Global Trends in Crypto Adoption

Global crypto adoption is experiencing diverse trends. Increased institutional investment is a key factor, with larger financial players showing growing interest. Simultaneously, retail adoption remains strong, particularly in developing nations where traditional financial systems are less accessible. However, regulatory uncertainty significantly impacts adoption rates, creating both opportunities and challenges across different regions.

Geographic disparities are also apparent. While some countries embrace cryptocurrencies through clear regulatory frameworks, others maintain a more restrictive stance, hindering widespread adoption. The level of cryptocurrency literacy within a population also correlates with adoption rates. Increased education and understanding of crypto technologies are vital for future growth.

Specific use cases are driving adoption. Decentralized finance (DeFi) applications and non-fungible tokens (NFTs) have sparked increased interest, attracting both investors and users. The future trajectory of global crypto adoption will depend heavily on the interplay between technological advancements, regulatory developments, and overall economic conditions.