Navigating the volatile world of crypto trading can be daunting, but success is attainable with the right strategies. This article unveils 5 simple strategies to significantly improve your crypto trading performance. Learn how to mitigate risk, maximize profit, and develop a winning cryptocurrency trading plan through actionable steps and insightful advice. Discover the secrets to achieving consistent success in crypto trading and unlock your potential for substantial returns. This guide is designed for both beginner and experienced traders seeking to enhance their skills and navigate the complexities of the crypto market.

Set Clear Profit Targets

Defining clear profit targets is crucial for successful crypto trading. Without predetermined targets, traders risk emotional decision-making, leading to impulsive trades and missed opportunities. Setting targets allows for disciplined profit-taking, preventing greed from overriding rational strategy.

Establish realistic targets based on your risk tolerance and market analysis. Consider using percentage-based targets (e.g., aiming for a 10% profit on each trade) rather than fixed-dollar amounts, which adapt better to market volatility. This approach promotes consistency and helps avoid chasing unrealistic gains.

Furthermore, incorporating stop-loss orders alongside profit targets is essential risk management. This strategy protects your capital from significant losses should the market move against your position. By combining profit targets and stop-losses, you create a defined risk-reward profile for each trade, promoting a more disciplined and successful trading approach.

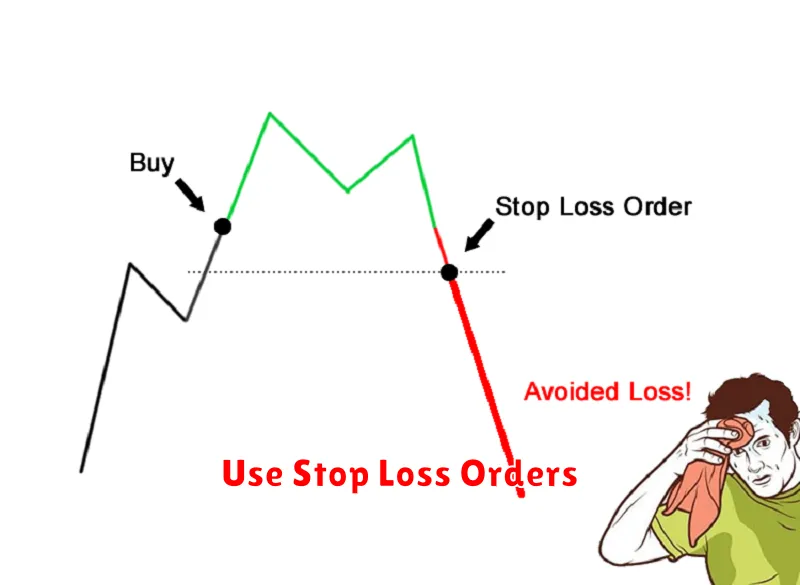

Use Stop Loss Orders

Protecting your investment is paramount in the volatile world of cryptocurrency trading. Stop-loss orders are crucial for mitigating potential losses. These orders automatically sell your cryptocurrency when the price drops to a predetermined level, limiting your downside risk.

Setting a stop-loss order involves identifying a price point below your entry price. If the market moves against you, your assets are sold at that pre-set price, preventing further significant losses. While it doesn’t guarantee profits, it helps manage risk effectively.

The placement of your stop-loss order should be strategic. Consider factors like market volatility and your risk tolerance when determining the appropriate price. Placing it too tightly may trigger the order prematurely on minor market fluctuations, while setting it too loosely could result in larger losses if the market takes a significant downturn. Thorough research and understanding of your chosen cryptocurrency are essential before setting a stop-loss order.

By consistently using stop-loss orders, you instill a disciplined approach to risk management within your trading strategy. This helps preserve capital and allows you to participate in the market while minimizing the impact of unpredictable price swings.

Diversify Your Crypto Portfolio

Diversification is a cornerstone of successful crypto trading. Don’t put all your eggs in one basket. Spreading your investment across different cryptocurrencies mitigates risk. A downturn in one asset is less impactful when balanced by gains or stability in others.

Consider diversifying across various market capitalizations. Include both large-cap (established, less volatile) and small-cap (higher growth potential, higher risk) cryptocurrencies. This balances potential for high returns with reduced overall portfolio volatility.

Furthermore, diversify across different asset classes. Explore beyond just cryptocurrencies. Consider including assets like stablecoins (pegged to fiat currencies) to provide a stable base for your portfolio and potentially DeFi tokens for exposure to decentralized finance platforms. This holistic approach helps create a resilient portfolio adaptable to market fluctuations.

Remember, the optimal level of diversification depends on your individual risk tolerance and investment goals. Thorough research is crucial before investing in any cryptocurrency. Consult a financial advisor if needed.

Learn Technical Analysis Basics

Technical analysis is crucial for successful crypto trading. It involves studying past market data—like price and volume—to predict future price movements. Chart patterns, such as head and shoulders or triangles, signal potential trend reversals or continuations. Moving averages (MAs), like simple moving averages (SMAs) and exponential moving averages (EMAs), smooth out price fluctuations and identify trends.

Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are indicators that help gauge momentum and potential overbought or oversold conditions. RSI values above 70 suggest an overbought market, while values below 30 signal an oversold one. MACD uses two moving averages to identify momentum shifts and potential trend changes. Understanding these tools enhances your ability to identify entry and exit points.

Support and resistance levels are crucial price points. Support is a level where the price is likely to find buyers and bounce back, while resistance is a level where sellers are likely to dominate, pushing prices down. Identifying these levels can help you manage risk and optimize trading decisions. Always remember that technical analysis is not a guaranteed method for predicting the market and should be combined with other forms of analysis for a holistic approach.

Start Small to Minimize Risk

One of the most crucial strategies for successful crypto trading is starting with a small investment. This significantly minimizes potential losses, especially during the initial learning phase. Begin with an amount you’re comfortable losing entirely without impacting your financial stability. This allows you to gain practical experience and develop your trading skills without facing substantial financial repercussions.

Avoid investing more than you can afford to lose. The cryptocurrency market is inherently volatile; starting small helps you navigate this volatility and learn risk management techniques without jeopardizing your overall financial well-being. As your confidence and understanding grow, you can gradually increase your investment.

This approach also allows you to experiment with different trading strategies and learn from your mistakes without incurring significant financial penalties. By starting small, you transform potential losses into valuable learning experiences that contribute to your long-term success in crypto trading.