Embarking on your cryptocurrency trading journey can feel daunting, but with the right guidance, it can be incredibly rewarding. This article outlines 5 essential tips for beginner crypto traders, equipping you with the knowledge to navigate the volatile world of digital assets. Learn how to secure your investments, manage risk effectively, and make informed trading decisions to maximize your chances of successful cryptocurrency trading. Whether you’re interested in Bitcoin, Ethereum, or other altcoins, mastering these fundamental strategies will significantly improve your trading experience.

Start with a Demo Account

Before investing real money, begin with a demo account. This allows you to practice trading strategies, understand market fluctuations, and familiarize yourself with the platform without risking any capital. It’s a risk-free environment to develop your trading skills and build confidence.

Demo accounts typically provide virtual currency to simulate real trading conditions. You can execute trades, analyze charts, and monitor your performance – all without financial consequences. This valuable practice period helps minimize losses and maximize learning when you eventually transition to live trading.

Take advantage of the educational resources many platforms offer alongside their demo accounts. These resources may include tutorials, webinars, and market analysis tools designed to enhance your understanding of the crypto market.

Remember, mastering a demo account doesn’t guarantee success in live trading, but it significantly reduces the learning curve and helps you avoid costly mistakes. It’s a crucial first step in your crypto trading journey.

Understand Market Trends

Successfully navigating the cryptocurrency market requires a keen understanding of market trends. Trend analysis is crucial for making informed trading decisions. This involves identifying patterns and movements in price, volume, and market sentiment.

Begin by learning to differentiate between bullish (upward) and bearish (downward) trends. Observe price charts to identify support and resistance levels, which represent price points where buying and selling pressure is strong. These levels can indicate potential price reversals or continuation of a trend.

Utilize technical indicators such as moving averages and relative strength index (RSI) to gauge momentum and potential overbought or oversold conditions. These tools can help confirm existing trends or signal potential shifts. Remember that technical analysis is not foolproof, and it should be used in conjunction with fundamental analysis.

Pay close attention to market news and events that can significantly impact cryptocurrency prices. Regulatory changes, technological advancements, and macroeconomic factors can all influence market trends. Staying informed is crucial for anticipating potential price swings.

Finally, practice risk management. Never invest more than you can afford to lose. Diversify your portfolio and consider using stop-loss orders to limit potential losses during adverse market conditions. Understanding market trends is a continuous learning process; be patient, observe consistently and learn from your experience.

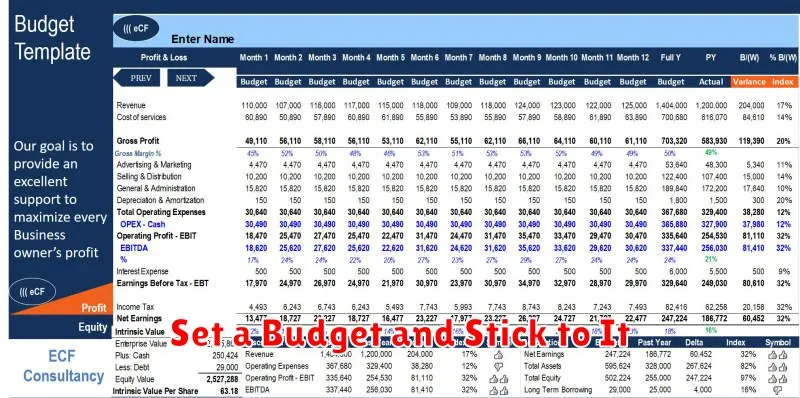

Set a Budget and Stick to It

Before you even think about buying your first cryptocurrency, set a budget. Determine how much money you can afford to lose without impacting your financial stability. Cryptocurrency markets are notoriously volatile, and losses are a possibility. Only invest what you can comfortably afford to lose.

Once your budget is set, stick to it religiously. Avoid the temptation to invest more than you planned, even if you’re experiencing early success. Emotional decision-making is a common pitfall for new traders, leading to impulsive and often detrimental investments. A predetermined budget helps maintain discipline and prevents overexposure to risk.

Tracking your investments within your budget is crucial. Maintain a spreadsheet or use a dedicated portfolio tracker to monitor your holdings and gains/losses. This helps you stay organized and understand your investment performance within the confines of your pre-defined budget.

Remember, consistent adherence to your budget is a cornerstone of successful and responsible cryptocurrency trading. It protects you from significant financial setbacks and allows you to learn and grow as a trader without undue pressure.

Learn to Read Charts

Understanding cryptocurrency charts is crucial for successful trading. Charts visually represent price movements over time, providing insights into trends, support and resistance levels, and volume.

Begin by familiarizing yourself with basic chart types like candlestick charts and line charts. Candlesticks display the open, high, low, and close prices for a specific period, offering a clear picture of price action. Line charts show price movements over time, highlighting trends.

Learn to identify key indicators such as moving averages (e.g., 50-day, 200-day), which smooth out price fluctuations and reveal trends. Relative Strength Index (RSI) and MACD (Moving Average Convergence Divergence) are also valuable tools to gauge momentum and potential trend reversals. Remember, indicators are not predictive but rather provide context for decision making.

Practice interpreting chart patterns. Recognizing common patterns like head and shoulders, double tops/bottoms, and flags can help anticipate future price movements. Combine chart analysis with other forms of market research for a well-rounded approach.

Finally, practice is key. Start with demo trading to hone your skills before risking real capital. Gradually increase your complexity of analysis as you gain experience and confidence.

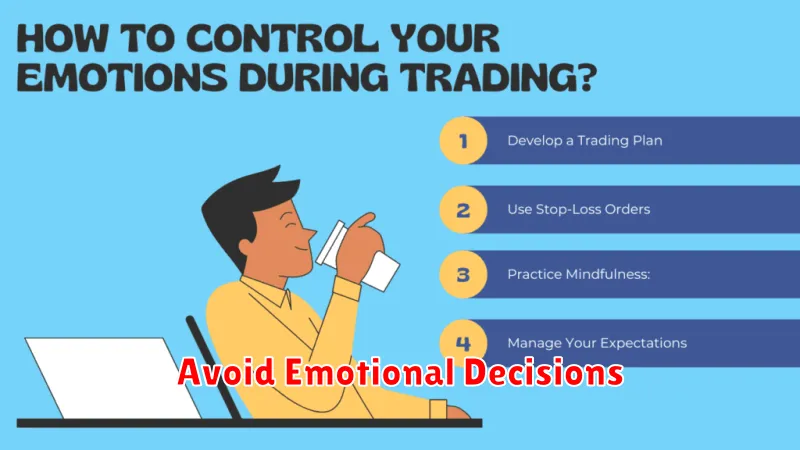

Avoid Emotional Decisions

The cryptocurrency market is highly volatile, leading to significant price swings that can trigger emotional responses. Avoid making impulsive trades based on fear or greed. Fear, often triggered by market downturns, can lead to panic selling at a loss. Conversely, greed, fueled by rapid price increases, can result in buying at inflated prices, setting you up for potential significant losses.

Develop a robust trading plan that outlines your entry and exit strategies, risk tolerance, and investment goals. Sticking to your plan, regardless of market sentiment, will help you remain disciplined and avoid emotional decision-making. This requires patience and discipline, key components for success in cryptocurrency trading.

Regularly review your portfolio and assess your performance against your pre-defined goals. This helps maintain objectivity and prevents emotional biases from influencing future trading decisions. Analyze both successful and unsuccessful trades to identify areas for improvement and to refine your strategy. Emotional detachment is crucial for rational and profitable trading.