Are you considering a long-term investment in the exciting world of cryptocurrencies? Navigating the volatile landscape of digital assets can be daunting, but identifying top cryptocurrencies with strong fundamentals and future potential is key to success. This article unveils the top 10 cryptocurrencies poised for significant long-term growth, offering a carefully curated selection based on market capitalization, technological innovation, and adoption rates. Discover which digital assets have the potential to shape the future of finance and become a cornerstone of your diversified investment portfolio. Learn about the best cryptocurrencies to invest in for lasting returns.

Bitcoin (BTC)

Bitcoin (BTC), the first and most well-known cryptocurrency, remains a compelling long-term investment option. Its pioneering status and established market dominance offer a degree of stability relative to other cryptocurrencies.

However, volatility remains a significant factor. While its price has historically shown remarkable growth, it’s also experienced dramatic drops. Investors should possess a high risk tolerance and a long-term perspective to weather these fluctuations.

Decentralization is a key strength; Bitcoin operates independently of central banks and governments, making it resistant to censorship and inflation. Its limited supply of 21 million coins contributes to its potential for scarcity-driven value appreciation.

Despite its advantages, regulatory uncertainty and the evolving landscape of the cryptocurrency market pose potential risks. Thorough research and due diligence are crucial before investing in Bitcoin.

Ethereum (ETH)

Ethereum is a decentralized, open-source blockchain platform with smart contract functionality. Unlike Bitcoin, which primarily focuses on transactions, Ethereum allows for the creation of decentralized applications (dApps) and other complex functionalities.

Its native cryptocurrency, Ether (ETH), fuels the network and is used for transaction fees and dApp interactions. The platform’s versatility and robust ecosystem make it a strong contender for long-term investment.

Smart contracts on Ethereum enable automation and trustless transactions, driving innovation in various sectors like finance (DeFi), gaming (NFT), and supply chain management. This adaptability contributes to ETH’s potential for sustained growth.

While volatility remains a characteristic of cryptocurrencies, Ethereum’s established position and ongoing development, including advancements like Ethereum 2.0, suggest a promising future for long-term holders.

However, potential risks include regulatory uncertainty and competition from other blockchain platforms. Thorough research and careful risk assessment are crucial before investing.

Binance Coin (BNB)

Binance Coin (BNB) is the native cryptocurrency of the Binance exchange, one of the world’s largest cryptocurrency exchanges. Its primary utility is to reduce trading fees on the Binance platform, offering a significant discount to holders.

Beyond fee reductions, BNB has expanded its utility significantly. It’s used within the Binance ecosystem for various purposes, including staking, payments, and access to exclusive offerings. The Binance Smart Chain (BSC), a separate blockchain powered by BNB, further fuels its growth and adoption.

Long-term investment potential in BNB is linked to the continued success and expansion of the Binance ecosystem. As Binance expands its services and user base, the demand for BNB is likely to increase, potentially driving its value upward. However, as with any cryptocurrency, investment in BNB carries inherent risks, including market volatility and regulatory uncertainty.

Ripple (XRP)

Ripple (XRP) is a cryptocurrency designed for fast and low-cost international payments. It operates on a distributed ledger technology called the RippleNet, which banks and financial institutions utilize for cross-border transactions.

XRP’s value proposition lies in its potential to disrupt the traditional SWIFT system, offering a faster, more efficient, and cheaper alternative. However, regulatory uncertainty surrounding XRP and its classification as a security remains a significant risk factor for long-term investors.

Despite this, XRP has a large and established network of partners, suggesting a degree of market adoption. Its potential for future growth hinges on the resolution of regulatory challenges and wider adoption by financial institutions.

Potential long-term benefits include significant price appreciation should the regulatory hurdles be overcome and broader adoption materialize. However, investors must be aware of the inherent risks associated with cryptocurrency investments, including volatility and potential regulatory actions.

Litecoin (LTC)

Litecoin (LTC), often referred to as “silver” to Bitcoin’s “gold,” is a peer-to-peer cryptocurrency established in 2011. It shares many similarities with Bitcoin, including its use of cryptographic hashing for security, but boasts faster transaction times and a larger potential supply.

Key advantages for long-term investors include its established track record, widespread acceptance among merchants, and its active development community. These factors contribute to its relative stability compared to some newer cryptocurrencies. However, its price is still highly volatile and subject to market fluctuations.

Potential risks involve the overall volatility of the cryptocurrency market, competition from other altcoins, and the potential for regulatory changes. While Litecoin has a strong history, its long-term success is not guaranteed. Careful consideration of these factors is crucial before investing.

Consider diversification as part of any investment strategy. Don’t invest more than you can afford to lose, and conduct thorough research before making any decisions.

Chainlink (LINK)

Chainlink is a decentralized oracle network that connects smart contracts to real-world data. This crucial function allows blockchain applications to access external data sources reliably and securely, a limitation that previously hindered their widespread adoption.

As a long-term investment, Chainlink presents several compelling aspects. Its decentralized architecture enhances security and resilience against censorship. The growing adoption of smart contracts across various industries, from finance to supply chain management, fuels increased demand for reliable oracle services, directly benefiting Chainlink.

While price volatility is inherent in the cryptocurrency market, Chainlink’s fundamental value proposition—providing secure and reliable data feeds for smart contracts—positions it for sustained growth in the long term. However, potential investors should conduct thorough research and understand the inherent risks associated with cryptocurrency investments before making any decisions.

Cardano (ADA)

Cardano (ADA) is a blockchain platform designed to be a more scalable and sustainable alternative to other cryptocurrencies. Its unique selling point lies in its peer-reviewed research-driven development, focusing on academic rigor and robust security.

ADA aims to address some of the limitations of other blockchain technologies, such as transaction speed and energy consumption. It uses a proof-of-stake (PoS) consensus mechanism, making it significantly more energy-efficient than proof-of-work (PoW) systems. This also makes it potentially more environmentally friendly.

The platform boasts a strong community and actively develops its ecosystem through decentralized applications (dApps) and smart contracts. However, potential investors should carefully weigh the inherent risks involved in cryptocurrency investment, including market volatility and regulatory uncertainties.

Long-term investors might find Cardano attractive due to its focus on sustainability, scalability, and its commitment to academic research and development. Its potential for widespread adoption, driven by its relatively fast transaction speeds and low fees, could contribute to significant growth over the long term.

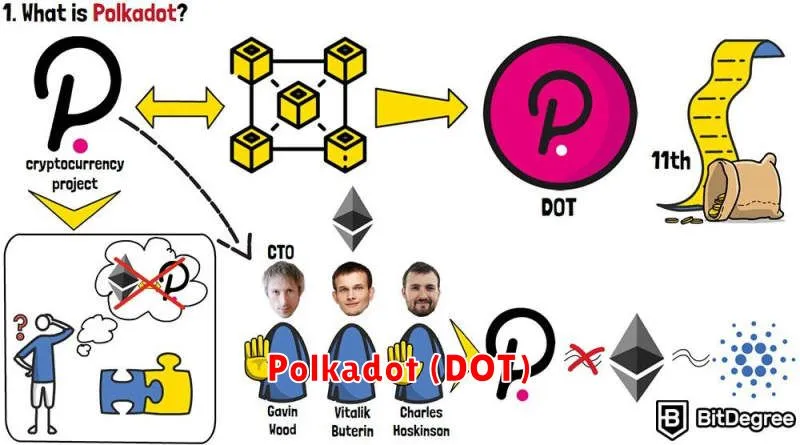

Polkadot (DOT)

Polkadot is a blockchain interoperability protocol designed to connect various blockchains, allowing them to communicate and share data seamlessly. This “multi-chain” approach aims to address scalability and interoperability issues plaguing many existing blockchains.

DOT, its native token, is used for governance, staking, and transaction fees within the Polkadot ecosystem. Holding DOT allows users to participate in network upgrades and decision-making processes.

As a long-term investment, Polkadot’s potential lies in its ability to facilitate cross-chain communication, fostering a more interconnected and efficient decentralized web. The success of its interoperability features could significantly impact the wider cryptocurrency landscape.

However, potential investors should be aware of the inherent risks associated with cryptocurrency investments, including market volatility and technological advancements that could impact Polkadot’s future.

Key features contributing to Polkadot’s long-term potential include its robust security model, active development community, and growing adoption among developers.

Solana (SOL)

Solana is a high-performance blockchain known for its speed and scalability. Its unique architecture, combining a proof-of-history consensus mechanism with a proof-of-stake system, allows for significantly faster transaction processing than many other blockchains. This makes it attractive for decentralized applications (dApps) requiring rapid transaction speeds.

A key strength of Solana is its robust ecosystem, supporting a growing number of DeFi projects, NFTs, and other applications. This vibrant ecosystem fuels demand and contributes to its potential for long-term growth.

However, potential risks include the relatively new nature of the technology and its susceptibility to network congestion during periods of high activity. Investors should carefully consider these factors before making any investment decisions.

Overall, Solana presents a compelling proposition for long-term investment due to its technological advantages and dynamic ecosystem. Nevertheless, thorough due diligence is crucial given the inherent volatility and risks associated with the cryptocurrency market.

Avalanche (AVAX)

Avalanche (AVAX) is a layer-1 blockchain designed for high throughput and low latency. Its unique consensus mechanism, a variation of Proof-of-Stake, allows for fast transaction speeds and scalability. This makes it attractive for decentralized applications (dApps) requiring rapid and efficient processing.

A key advantage of AVAX is its subnets feature. This allows for the creation of customized blockchains within the Avalanche ecosystem, tailoring them to specific use cases. This flexibility could contribute to its long-term growth and adoption.

AVAX also boasts a thriving developer ecosystem, with numerous projects building on its platform. This vibrant community is crucial for the continued development and improvement of the network, enhancing its long-term prospects.

While promising, investing in cryptocurrencies like AVAX carries significant risk. Market volatility and regulatory uncertainty are factors to consider before making any investment decisions.