Are you looking to diversify your investment portfolio with high-growth potential cryptocurrencies? This article explores 10 rising cryptocurrencies poised for long-term growth, offering insights into their underlying technologies and market potential. We’ll delve into promising projects with the potential to deliver significant returns, helping you navigate the dynamic world of digital assets and identify top cryptocurrencies for your investment strategy. Discover which altcoins and blockchain technologies are attracting attention from experts and investors alike, and make informed decisions about your cryptocurrency investments for the future.

Avalanche (AVAX)

Avalanche (AVAX) is a fast, scalable, and secure platform for building decentralized applications (dApps) and launching custom blockchain networks. Its unique consensus mechanism allows for significantly faster transaction speeds compared to other prominent blockchains. This speed, combined with its low transaction fees, makes it an attractive option for developers.

The AVAX token fuels the Avalanche ecosystem, used for transaction fees, staking, and governance. Its robust infrastructure and growing developer community position AVAX as a potential long-term investment. However, as with any cryptocurrency, investment in AVAX involves inherent risk.

Key strengths of Avalanche include its high throughput, low latency, and ease of use. The platform’s focus on interoperability also facilitates communication and asset transfer between different blockchains.

While potential risks exist with all cryptocurrencies, including market volatility and regulatory uncertainty, Avalanche’s technological advantages and strong community support contribute to its potential for long-term growth.

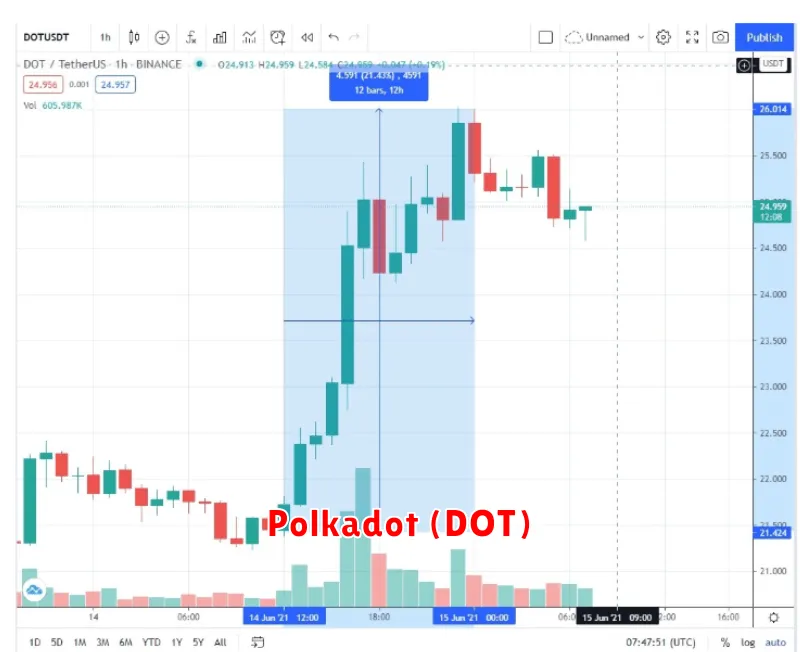

Polkadot (DOT)

Polkadot is a blockchain interoperability protocol designed to connect different blockchains, allowing them to communicate and share data seamlessly. This is a significant advantage, as it facilitates cross-chain transactions and the development of decentralized applications (dApps) that can leverage the strengths of multiple blockchain networks.

The native token, DOT, is used for governance, staking, and transaction fees within the Polkadot ecosystem. Staking DOT allows users to participate in network security and governance decisions, earning rewards in the process. The project’s focus on scalability and interoperability positions it as a potential long-term growth asset in the evolving cryptocurrency landscape.

Polkadot’s modular architecture allows for the development and integration of parachains, independent blockchains that benefit from Polkadot’s security and interconnectivity. This fosters innovation and the creation of specialized blockchain solutions tailored to various applications. Its strong community and active development further contribute to its potential for future growth.

Cardano (ADA)

Cardano (ADA) is a proof-of-stake blockchain platform designed for scalability and sustainability. It emphasizes peer-reviewed research and a multi-stage development process, aiming for a more secure and robust ecosystem compared to some competitors. ADA, its native cryptocurrency, facilitates transactions and smart contract execution within the Cardano network.

One of Cardano’s key strengths lies in its scalability. Its layered architecture allows for higher transaction throughput and improved efficiency. Furthermore, the platform’s focus on decentralization and sustainability positions it as a long-term contender in the cryptocurrency space. However, its relatively slow development pace compared to some other projects might be a factor to consider.

Potential for long-term growth for Cardano stems from its robust technological foundation, ongoing development, and the growing adoption of its decentralized applications (dApps). Its focus on regulatory compliance and collaboration with established institutions could also contribute to its broader acceptance.

Solana (SOL)

Solana is a high-performance blockchain known for its speed and scalability. Its unique architecture, combining proof-of-history with proof-of-stake, allows for significantly faster transaction processing than many other blockchains. This makes it attractive for decentralized applications (dApps) requiring quick and efficient transactions.

Key features contributing to Solana’s potential for long-term growth include its robust ecosystem, which supports a growing number of DeFi projects and NFTs; its relatively low transaction fees; and ongoing development efforts to enhance its capabilities. However, investors should be aware of the risks associated with all cryptocurrencies, including potential volatility and regulatory uncertainty.

Potential for growth stems from the increasing demand for faster and more scalable blockchain solutions. If Solana continues to address its challenges and enhance its technology, it could capture a significant share of the decentralized application market, leading to potential long-term value appreciation.

Fantom (FTM)

Fantom (FTM) is a layer-1 blockchain aiming to provide high throughput and low latency transactions. Its aDAG-based aBFT consensus mechanism allows for fast and efficient processing of transactions.

Key features include its scalability, achieved through its unique architecture, and its focus on decentralized finance (DeFi) applications. The platform supports smart contracts and offers a robust ecosystem for developers.

While still a relatively new project, Fantom has shown significant growth and adoption, attracting attention for its potential for long-term growth in the ever-expanding DeFi space. The FTM token serves as the native currency within the Fantom ecosystem.

Risks associated with Fantom include the inherent volatility of the cryptocurrency market and the ongoing competition from other layer-1 blockchains. However, its strong technology and focused development suggest a possible long-term investment opportunity.

Near Protocol (NEAR)

Near Protocol (NEAR) is a high-performance, scalable blockchain designed for ease of use and developer-friendly tools. It aims to solve the scalability issues often faced by other blockchain networks, offering a faster and cheaper transaction experience.

NEAR’s unique sharding technology allows for parallel processing of transactions, significantly increasing throughput. This makes it suitable for handling a large number of users and applications without compromising speed or efficiency. Its focus on developer experience, with tools like its Javascript-based SDK, makes it attractive for building decentralized applications (dApps).

Key features contributing to its long-term growth potential include its user-friendly interface, robust ecosystem, and commitment to developer support. The growing number of dApps being built on the NEAR platform suggests a vibrant and expanding community.

While NEAR faces competition from other layer-1 blockchains, its focus on scalability and developer experience positions it favorably for continued growth in the evolving cryptocurrency landscape. Its relatively young age also presents considerable potential for future development and adoption.

Algorand (ALGO)

Algorand (ALGO) is a pure proof-of-stake (PPoS) blockchain designed for scalability and security. Its unique consensus mechanism ensures fast transaction speeds and low energy consumption, addressing some key limitations of other blockchain networks. This makes it attractive for various applications, including decentralized finance (DeFi) and non-fungible token (NFT) marketplaces.

Scalability is a core strength of Algorand, allowing it to handle a high volume of transactions without sacrificing speed or security. This, combined with its decentralized governance model, positions Algorand as a promising platform for long-term growth in the cryptocurrency space. The focus on decentralization and sustainability further enhances its appeal to investors seeking environmentally conscious and robust cryptocurrencies.

While adoption is still growing, Algorand’s strong technological foundation and focus on real-world applications suggest it has the potential for significant future growth. However, as with all cryptocurrencies, investment carries inherent risks and potential for volatility. Thorough research and careful consideration of personal risk tolerance are crucial before investing.

Hedera (HBAR)

Hedera Hashgraph (HBAR) is a public, distributed ledger platform that utilizes a novel consensus mechanism called hashgraph. Unlike blockchain’s linear approach, hashgraph boasts significantly faster transaction speeds and higher throughput, making it suitable for large-scale applications.

Key features driving HBAR’s potential for long-term growth include its speed, scalability, and governance structure. Its unique consensus algorithm ensures high transaction speeds and low latency, ideal for various use cases like decentralized finance (DeFi) and supply chain management.

The platform’s focus on enterprise adoption, with a governing council comprised of established global organizations, adds credibility and fosters trust among businesses. This strategic approach could contribute to widespread adoption and increased value for HBAR in the long run.

While promising, potential investors should understand the inherent risks associated with any cryptocurrency investment, including market volatility and technological uncertainties. Thorough research is crucial before investing.

Chainlink (LINK)

Chainlink is a decentralized oracle network that aims to bridge the gap between blockchain technology and the real world. It facilitates the secure transmission of real-world data onto smart contracts, enabling the creation of more complex and reliable decentralized applications (dApps).

Key features include its decentralized nature, which enhances security and reliability, and its ability to integrate with various data sources, making it versatile and adaptable. The LINK token is crucial for securing and incentivizing the network’s operation.

Long-term growth potential stems from the increasing demand for reliable data feeds in the DeFi (Decentralized Finance) and broader blockchain ecosystem. As the adoption of blockchain technology expands, the need for robust and secure oracle networks like Chainlink is expected to increase significantly, potentially driving the value of LINK.

However, risks include competition from other oracle solutions and the overall volatility of the cryptocurrency market. While Chainlink enjoys strong adoption, its long-term success depends on continued innovation and the broader acceptance of blockchain technology.

Polygon (MATIC)

Polygon (MATIC) is a layer-2 scaling solution for Ethereum, designed to address issues of scalability and high transaction fees. It achieves this by utilizing a sidechain network, enabling faster and cheaper transactions while maintaining compatibility with the Ethereum ecosystem.

Key advantages include significantly reduced transaction costs and faster processing times compared to the Ethereum mainnet. This makes Polygon attractive for various decentralized applications (dApps) and users seeking a more efficient experience.

Growth potential stems from the increasing demand for scalable blockchain solutions and the expanding Ethereum ecosystem. Polygon’s strong developer community and partnerships contribute to its continued development and adoption.

Investment considerations should involve understanding the risks associated with cryptocurrency investments, including volatility and market fluctuations. Researching Polygon’s technology, adoption rate, and competitive landscape is crucial before investing.